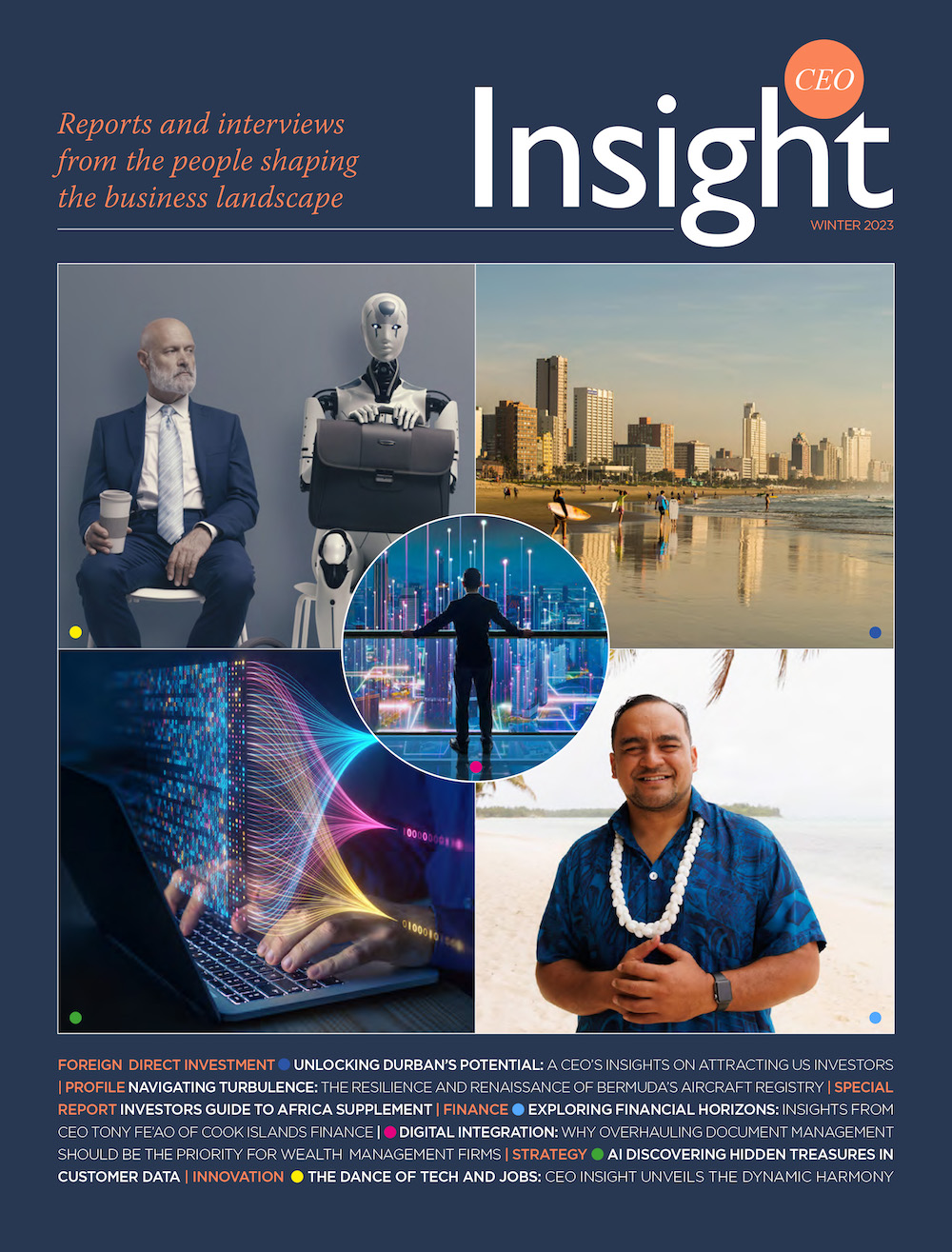

What do banks and fintechs need to do to get fraud-fighting systems up to scratch? Artificial Intelligence (AI) is no longer science fiction. It’s now reality – and depending on who you talk to, AI ...

The Global Entrepreneurship Monitor (GEM) survey has crowned the United Arab Emirates (UAE) as the premier destination globally for initiating a new venture for the third consecutive year. This accolade underscores the UAE’s concerted drive ...

Discusses his role as the Finance Minister and the Cook islands development.

We are privileged to interview Dr.Graham Bright JP, Head of Compliance and Operation at Euro Exim Bank, a financial institution with global ambitions in trade finance. Euro Exim Bank has set its sights on the ...

Step into the world of Cook Islands Finance with an exclusive interview featuring CEO Tony Fe’ao. Gain insights into the innovative financial products, brand-building endeavours, and strategic partnerships shaping the organization’s dynamic presence in the ...

Why overhauling document management should be the priority for wealth management firms Overhauling processes and infrastructure during digital integration can be an arduous process. Industries such as wealth management should not have to compromise on ...

Digital wallets have revolutionised the way people manage their money. With the convergence of in-store and ecommerce payments, personalised journeys and heightened expectations, today’s tech-savvy customers demand faster and frictionless digital wallet services from their ...

近年来,安提瓜和巴布达通过其创新的投资入籍计划,见证了那些寻求公民身份的人的动机发生了令人着迷的转变。本次独家专访深入探讨了不断变化的格局,探讨了投资者现在是否优先考虑生活方式的改善和企业扩张,而不是增强流动性的传统诱惑力。我们与投资入籍部门董事会主席杰弗里·哈迪德(Jeffery Hadeed)大使进行了交谈,以揭示该国的战略方针、多元化的投资者市场以及它为新公民提供的独特文化沉浸感。了解这个小岛国如何在竞争激烈的投资入籍领域脱颖而出。

Introduction In the dynamic world of finance, Capital Security Bank (CSB) stands in the spotlight, granting global investors access to over 40 international exchanges via its Online Trading Account services. Leading the charge is John ...

Dominic Hale speaks to Alan Taylor, CEO of Cook Islands Finance about the unique features and benefits of the South Pacific jurisdiction’s unique suite of pioneering and innovative products and services for those focused on ...

KwaZulu-Natal, South Africa’s eastern coast province has placed ESG front and centre as it seeks to realise a fairer and more prosperous future for all marked by sustainable development, social inclusion, and responsible governance. The ...

War and sanctions have pumped oil prices into the stratosphere, leaving fuel exporters laden with money. At the core of the development is the world’s first truly global energy crisis. After Russia’s invasion of Ukraine, ...

CEO Insight Interviews Capital Security Bank CEO John Evans. CEO: What would you describe as the most pertinent recent, current, and forthcoming developments at Capital Security Bank (CSB)? John Evans: CSB has achieved significant strategy ...

Malta has recently launched a residency programme for highly innovative startup and scale up ventures. Non-EU founders who would like to use Malta as their launch pad for their new business, from its strategic location ...

‘’Credit Suisse is the first major bank, deemed too big to fail, to take up the offer of an emergency lifeline. The announcement that it will draw on emergency funds from the Swiss National Bank ...

Malta is inviting non-EU entrepreneurs to launch their new ventures, or scale up their existing ones, using Malta as their base. The new Malta Startup Residence Programme is intended for third country nationals who are ...

For high-net worth individuals, their families and their professional advisors looking to implement a wealth management plan, the Cook Islands international financial services sector has become an unrivalled ‘go-to’ proposition. The associated infrastructure within the ...

Interview with Charmaine Quinland-Donovan, CEO, CIU Antigua and Barbuda CEO Insight: Why has citizenship investment become so important for global investors? Charmaine Quinland-Donovan: Profit optimization, portfolio diversification, access to new markets and tapping into unique business ...