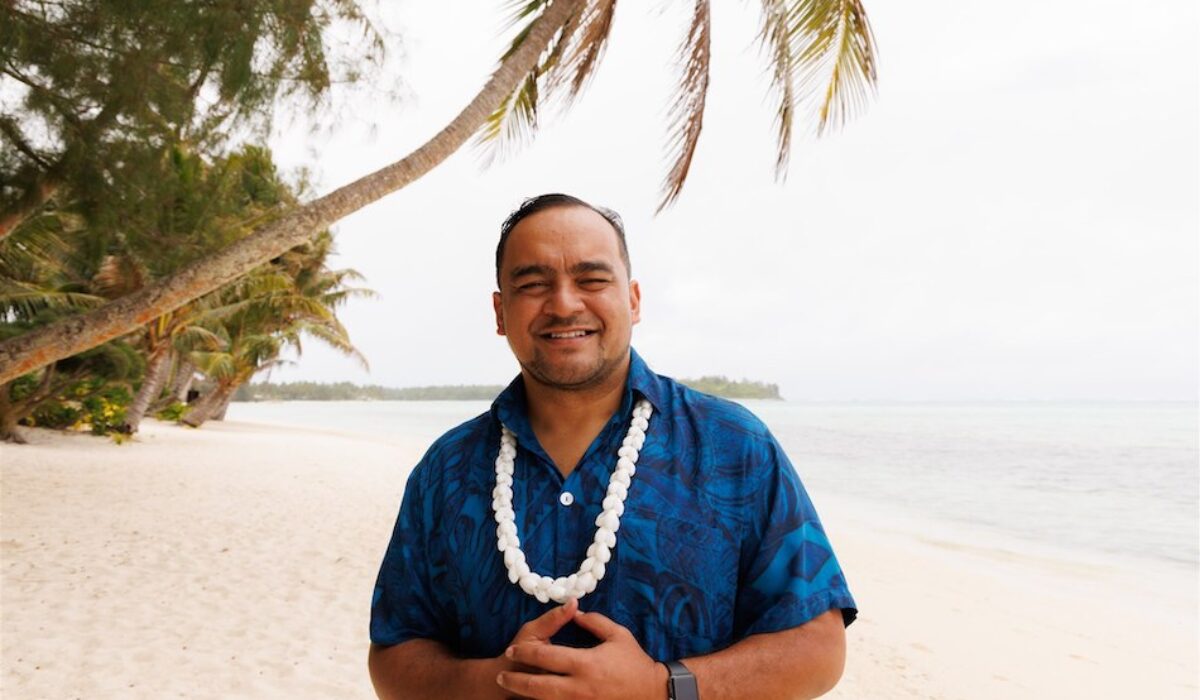

A Pioneering Financial Hub: Insights from Tony Fe’ao on the Cook Islands’ Financial Services

In this interview, Tony Fe’ao, a key figure in the Cook Islands financial sector, discusses the evolution, current offerings, and future directions of the Cook Islands as a premier jurisdiction for wealth management and asset protection. Over the past four decades, the Cook Islands has established itself as a well-regulated and highly regarded financial services hub, continually adapting to meet global best practices and the needs of its international clientele.

Dominic Hale: The Cook Islands has been a pioneering financial services jurisdiction for over four decades now. What has changed in that time in terms of its product and service offering?

Tony Fe’ao: The Cook Islands has evolved into a well-regulated, and highly regarded financial jurisdiction. We’ve aligned ourselves with global best practices, offer a comprehensive range of financial services and earned a reputation as a world leader in the protection of wealth.

We’ve built services and expertise around wealth management, and in particular the protection of wealth, developing a range of products and solutions, including trust administration, managed and private trust companies, international companies, limited liability companies and foundations. We also offer insurance, private banking and ship registry services.

Over the past 40 years, we have developed a network of highly skilled, and multi-disciplineed professionals in legal, accounting, and fiduciary services. Many are internationally trained and bring decades of experience in wealth management, both locally and globally

Dominic Hale: What would you describe as the Cook Islands’ signature product today?

Tony Fe’ao: The Cook Islands Asset Protection Trust (CIAPT) remains our signature product. Our world-leading asset protection legislation effectively safeguards assets from various legal and financial threats, providing a secure and stable solution for wealth preservation.

CIAPT features include:

- Foreign Judgments

Cook Islands courts do not recognise foreign judgments where they are based on law that is inconsistent with or governed by Cook Islands law . In these circumstances a judgment from a court in another country will not be enforceable in the Cook Islands and any claims against assets in a CIAPT must be re-litigated within our jurisdiction. - Forced Heirship

The assets in a CIAPT are safeguarded from the forced heirship rules governing any person related to the settlor. The International Trusts Act 1984 (ITA) does not recognise such forced heirship rules. - Bankruptcy

The integrity of a Cook Islands trust is maintained even if the trust’s settlor declares bankruptcy in another country. - Spendthrift Beneficiaries

The interests of beneficiaries in the assets of a Cook Islands trust are protected from creditors, bankruptcy, or other legal claims throughout their lifetime. - 2 Year Statute of limitation

Section 13B of ITA sets a two-year statute of limitations for challenging asset transfers into a CIAPT on grounds of fraudulent conveyance. Where a creditor’s cause of action arises within two years of the settlement being made, the creditor must file an action in in a court of competent jurisdiction within one year of the settlement taking place.

Once in the Cook Islands court, creditors must prove, beyond a reasonable doubt, that the specific transfer was intended to defraud them and made the Settlor insolvent.

“We are constantly reviewing and revising laws and regulations where necessary to align with global standards and address international requirements.”

The Cook Islands International Relationship Trust (IRPT) is our most recent trust product. Specified trust assets in an IRPT settled by a couple are safeguarded and kept intact for the trustee to administer if they separate or divorce – preserving the assets for the couple and, more importantly, their children.

Dominic Hale: How has the Cook Islands managed to stay ahead of a complex and ever-evolving international regulatory landscape?

Tony Fe’ao: We are constantly reviewing and revising laws and regulations where necessary to align with global standards and address international requirements. This ensures compliance with frameworks set out by international organisations such as the European Union (EU), OECD and FATF.

Active collaboration with the EU, OECD and FATF helps the Cook Islands adhere to global best practices and changes. The Financial Supervisory Commission, the Cook Islands’ regulatory body, performs regular audits, monitoring, and compliance checks to ensure service providers are following both and local and international requirements.

Dominic Hale: Why the Cook Islands and not somewhere else for individuals and families looking to optimise management of their wealth?

Tony Fe’ao: The Cook Islands is the ideal jurisdiction for wealth management due to our unique combination of legal, regulatory, and practical expertise.

- World Class Asset Protection

The Cook Islands has some of the world’s strongest asset protection trust laws – which provide significant protection against creditors and legal claims. The asset protection provisions of the ITA , which are often referred to as the ‘Gold Standard’ in asset protection, have been applied and upheld by the Cook Islands courts since their enactment. Clients can establish tailored structures within our asset protection framework to meet specific wealth management needs, including asset protection, estate planning, and business and succession planning - Privacy Provisions

The Cook Islands does not have public registers for beneficial ownership of incorporated entities or trusts. Our laws contain privacy provisions and information will only be available on a court order or where requested by law enforcement or the regulator. Attempts to gather information without having specific grounds or evidence of wrongdoing (fishing expeditions) are not tolerated. - Legal and Regulatory Stability

The Cook Islands has a stable legal system based on common law principles, offering predictability and reliability. We have a High Court and a Court of Appeal, with the highest appellate court being the Privy Council in London. Judges in the High Court and Court of Appeal are experienced New Zealand judges who apply Cook Islands law.

- Tax-Neutral Jurisdiction

CIAPTS and Cook Islands international entities can be structured whereby local taxes will not be imposed, effectively making them tax neutral from a Cook lslands perspective. - Compliance with International Standards

The Cook Islands complies with international standards on anti-money laundering (AML) and counter-terrorism financing (CTF) and has an active and effective industry regulator. - Political and Economic Stability

The Cook Islands offers a politically and economically stable environment, minimising risks associated with geopolitical factors. We also maintain very strong social and economic ties with New Zealand. Our special relationship is characterised by a unique free association, allowing us full self-governance while benefiting from New Zealand’s economic support, diplomatic backing, and shared citizenship.

Dominic Hale: What current or forthcoming developments are you most excited about and why?

Tony Fe’ao: Given the increased interest and demand for captive insurance products and services around the world, we are looking to develop our captive insurance legislation to provide exciting opportunities for businesses seeking customised insurance solutions.

We’re also excited about the work we are doing in our local community to raise awareness round the financial services industry. This includes the benefits it brings to our economy, it’s low environmental impact and the career opportunities that are available to our young professionals. The financial services industry gives our people the opportunity to have a rewarding and well-paying career, while living and raising their families in our little paradise.