CEO Insight: Startups to Watch in 2026

There is no ranking here, and no attempt to crown a single winner. The companies that follow are listed united instead by a shared characteristic: they delivered in 2025. At a time when markets became more selective and execution mattered more than ambition, these businesses demonstrated real traction through partnerships, deployments, regulatory progress and commercially viable operating models.

Together, they offer a snapshot of where innovation is becoming infrastructure and where ideas have translated into systems that work. For CEOs, they provide clear signals of where capital, policy and enterprise demand are converging as 2026 begins.

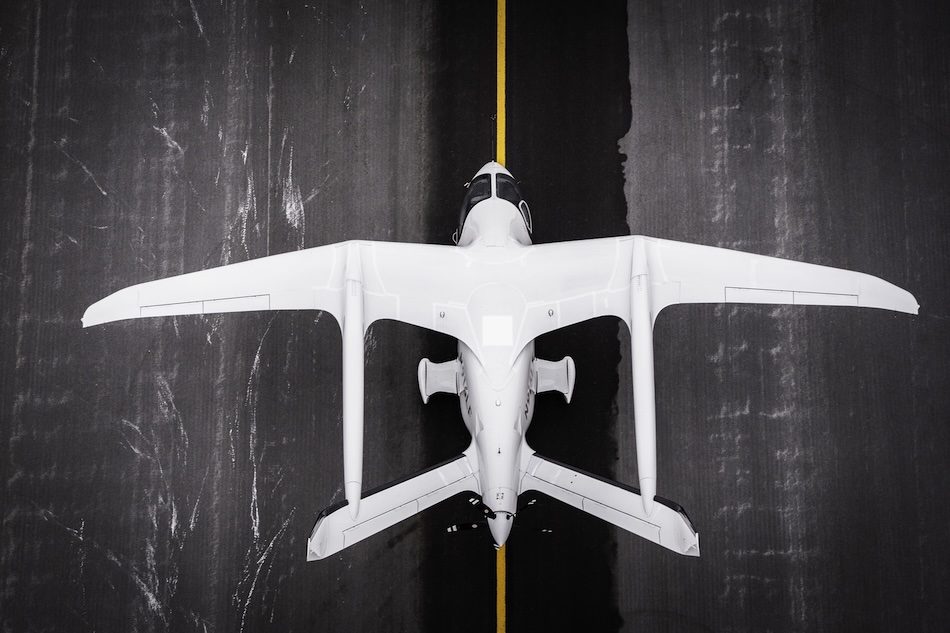

BETA Technologies

Sector: Electric aviation and charging infrastructure

BETA Technologies approaches electric aviation as an ecosystem rather than a single product. Its strategy integrates aircraft development with the ground infrastructure required for real adoption, including charging networks, pilot training and operational support.

This matters because the constraint on electrified aviation is not conceptual ambition but operational readiness. Airports, utilities, logistics operators and regulators all need systems that work together. BETA’s focus on building this full stack places it ahead of many competitors who remain narrowly focused on airframes alone.

Looking into 2026, the company’s relevance extends beyond aviation into logistics, infrastructure investment and regional connectivity, positioning it as a long-cycle electrification play with cross-sector implications.

Website: beta.team

Climeworks

Sector: Carbon removal

Climeworks has played a central role in turning carbon removal into a structured commercial category. Rather than treating direct air capture as a distant climate solution, the company has focused on delivery models that allow organisations to plan, contract and verify removal over long time horizons.

As scrutiny around climate claims has intensified, Climeworks’ emphasis on permanence, measurement and transparency has increased its relevance to executive teams. Carbon removal is increasingly viewed not as a marketing exercise, but as a governance and risk management decision.

In 2026, the strategic conversation will centre on how removal contracts evolve in duration, pricing and verification standards, with Climeworks well positioned to influence those frameworks.

Website: climeworks.com

Carbon Clean

Sector: Industrial carbon capture

Carbon Clean stands out for its pragmatic approach to industrial decarbonisation. Its modular carbon capture technology is designed to integrate into existing facilities, enabling emissions reduction without requiring wholesale redesign of industrial operations.

In 2025, the company strengthened its credibility through recognition within the global cleantech ecosystem and by progressing partnerships with major engineering and industrial groups. Its positioning reflects a growing demand for solutions that can be deployed this decade, rather than promised for the next.

For CEOs in heavy industry, Carbon Clean represents a pathway to compliance, emissions reduction and investor alignment that reflects operational realities.

Website: carbonclean.com

Waabi

Sector: Autonomous trucking

Waabi has distinguished itself by prioritising safety validation, simulation and regulatory readiness over publicity. Its approach treats autonomy as a systems challenge that must satisfy insurers, fleet operators, regulators and the public.

As freight networks face persistent cost pressure and labour constraints, the appeal of autonomy lies not in spectacle but in reliability. Waabi’s work in simulation driven testing offers a pathway to scale that reduces risk while accelerating readiness.

For executives overseeing complex supply chains, the company represents a disciplined vision of automation grounded in operational integration.

Website: waabi.ai

Innovafeed

Sector: Sustainable protein and circular inputs

Innovafeed has steadily industrialised insect protein into a mainstream supply input. Its model is built around circular economy principles, using agricultural by-products to create scalable, traceable protein for aquaculture and animal nutrition.

In 2025, the company’s focus on production discipline, consistency and cost control helped it move beyond novelty and into serious procurement conversations. For large buyers, the value lies in supply stability as much as sustainability.

As ingredient markets face volatility and regulatory pressure, Innovafeed’s approach offers a lower impact input aligned with enterprise scale demand.

Website: innovafeed.com

Burn Manufacturing

Sector: Clean cooking and distributed climate infrastructure

BURN Manufacturing demonstrates how climate aligned hardware can scale through manufacturing and distribution excellence. Its clean cooking products reduce emissions, lower household fuel costs and improve health outcomes across emerging markets.

What sets BURN apart is its vertically integrated model, combining manufacturing, retail distribution and carbon finance mechanisms. This enables scale without relying solely on subsidies or philanthropic funding.

For leaders focused on climate impact with measurable outcomes, BURN represents infrastructure that is used daily rather than intermittently.

Website: burnstoves.com

Huntress

Sector: Cybersecurity for SMEs and supply chains

Huntress addresses a growing blind spot in enterprise risk management. Cyber breaches increasingly originate through smaller suppliers and partners that lack dedicated security teams.

Huntress focuses on delivering enterprise grade threat detection and response through managed service providers, extending protection across distributed IT estates. This approach aligns with how many organisations actually operate rather than how security is often designed on paper.

For CEOs, the relevance is systemic risk reduction across supplier and partner ecosystems.

Website: huntress.com

Jetstream Africa

Sector: Digital freight and cross border trade

Jetstream Africa targets one of the most persistent constraints on growth in emerging markets: trade logistics friction. Its digital freight forwarding platform improves transparency, reduces delays and stabilises working capital cycles for exporters and importers.

By focusing on operational reliability rather than marketplace scale, Jetstream positions itself as trade infrastructure rather than a transactional intermediary.

For executives with exposure to emerging markets, logistics efficiency is often the difference between growth and stagnation.

Website: jetstreamafrica.com

Scale AI

Sector: Enterprise AI infrastructure

Scale AI operates at the enabling layer of artificial intelligence adoption. Rather than building consumer facing applications, it provides the data pipelines, evaluation tools and governance frameworks required to deploy AI in regulated and mission critical environments.

As organisations move from experimentation to integration, the ability to measure, audit and validate AI performance becomes essential. Scale AI’s positioning reflects that shift from innovation theatre to operational discipline.

For CEOs, the company represents the infrastructure that allows AI to move safely into core business processes.

Website: scale.com

Resilience

Sector: Biomanufacturing and CDMO platforms

Resilience focuses on strengthening global biomanufacturing capacity through modular, technology driven production platforms. Its model aims to shorten the path from development to commercial manufacturing while improving supply chain reliability.

In an environment shaped by health security concerns, geopolitical risk and demand volatility, manufacturing resilience has become a strategic priority. Resilience positions itself at the intersection of technology, healthcare and industrial capacity.

For executives in life sciences, healthcare and government facing sectors, this capability is increasingly strategic rather than operational.

Website: resilience.com