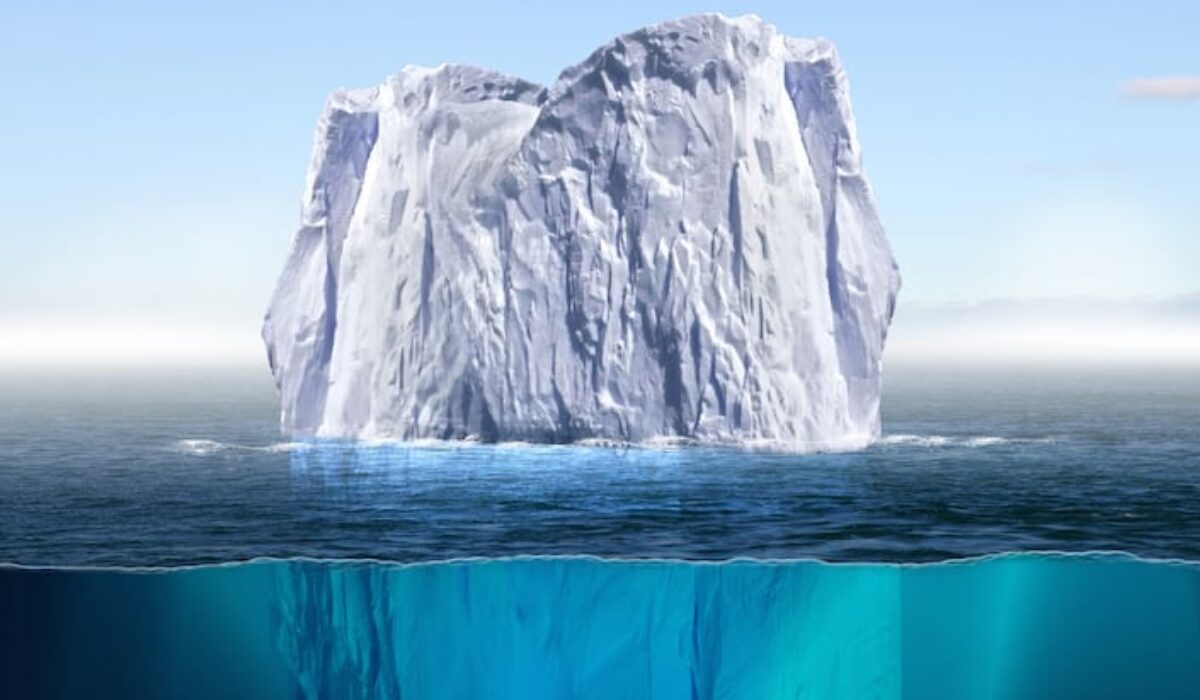

Drifting Icebergs and Other Tax-Planning Hazards

A strange-but-true look at the tax-planning impacts of pivotal economic, political, trade and regulatory changes

Who could have imagined that last year’s stunning Brexit vote was only the tip of the iceberg? Yet, here we are today, adjusting to the unpredictable nature of a U.S. President who took office following another astonishing vote; deciding if U.S. might push forward with a first-of-its-kind border-adjusted corporate income tax; hoping that a rare opportunity for historic U.S. tax reform will overcome political discord; watching the clock tick on the complex Britain-European Union (EU) divorce; responding to the EU’s ongoing State Aid investigations; and (by the way) complying with the OECD’s historic transformation of global tax compliance environment starting with the first Country-by-Country (CbC) reporting submissions this year.

These momentous, interrelated forces are taxing our ability to identify suitable analogies and paralysing many corporate-planning activities. Not only do these massive disruptions align in a “perfect storm” configuration, but the depth and might of their potential economic impacts resemble icebergs, which must be carefully avoided. These economic impacts – coupled with their political, social, legal and regulatory ripple effects – will have regional and then global consequences for decades, even generations, to come. Of course, tax-planning activities will be significantly affected; tax planning in many organisations remains stalled today as leaders seek a navigable course through troubled waters.

When examining how tax planning will change in response to these drifting hazards, it is useful to probe below the surface of direct policy impacts and assess the policy assumptions that will ultimately become accepted rules and practices. This type of probing can be difficult given all that we cannot see lurking below the surface and in the months ahead.

As a result, planning and forecasting has become ineffective at best; the implications of these changes are difficult to identify while their unintended consequences are nearly impossible to gauge. In light of this limited visibility, tax executives should remind themselves of a key distinction from the past. In his 1921 book “Risk, Uncertainty, and Profit,” University of Chicago economist Frank Knight emphasises the importance of distinguishing between risk and uncertainty. The former applies to scenarios whose outcomes, while unknown, can be assigned varying degrees of likelihoods. Uncertainty refers to scenarios to which it is impossible to assign any degree of likelihood.

“When deploying the right form of tax automation, tax functions can collect, harmonise, transform and access the massive amounts of data required to satisfy compliance around the world.”

Tax executives cannot plan for the precise impacts of potential U.S. tax reform, the final format of the legal procedures by which Britain will leave the EU, or the degree to which EU State Aid investigations and BEPS will recalibrate the global business environment. But tax executives can assign high odds to the possibility that these forces will elevate the importance of tax planning in multinational enterprises (MNEs).

As tax functions face growing pressure to perform real-time information-gathering to fulfill reporting requirements, agile tax planning becomes even more critical to their business’ competitiveness. Managing the risks that accompany the four icebergs described below hinges on the tax function’s access to data and its ability to quickly harvest relevant information from this data.

U.S. Tax Reform

Speaking of likelihoods, a recent Bloomberg headline urged readers to “Take the Odds on Corporate Tax Reform.” The column argued that some significant drivers were aligning to make reform a safe bet: the current 35 percent corporate tax rate is significantly higher than global norms; this rate is widely seen as holding back investment in U.S. businesses; and the growing consensus that most tax incentives and subsidies should be eliminated to create revenue necessary for a lower rate.

There was only one problem with this argument: it was published two years ago. This is not to say that U.S. tax reform is doomed. On the contrary, major reform appears as if it would be welcomed by many stakeholders, particularly given uncertainty concerning current fiscal conditions. Despite recent skepticism about the prospects for tax reform occurring in 2017, major change is more likely – and still generating more optimism – today than at almost any point since the Tax Reform Act of 1986 was signed by President Reagan.

The President and Congress appear committed to enacting substantive tax reform, as demonstrated by the recent release of an outline of tax reform principles from the White House. Optimistic-but-contentious tax reform debates have centered on several key issues that tax executives should address when conducting scenario planning, including:

• Corporate rate reduction: Will the final proposal reduce the statutory corporate tax rate (currently teetering at 35 percent) to 25 percent or down to 20 percent? Is the 15 percent rate proposed by the White House even possible? And what deductions will businesses have to give up in exchange? After all, corporation’s effective tax rate will be determined by both changes.

• Border-adjustment tax (BAT): The BAT proposed in the House of Representatives’ initial reform plan, referred to as the “Blueprint,” generated heated arguments. Proponents maintain that a BAT could generate as much as $1 trillion in 10 years while increasing the value of the U.S. dollar. Opponents decry the BAT as protectionist, cast doubt on its currency-strengthening powers, and note that it will harm U.S.-based importers. Interestingly, the President’s latest tax reform proposal is silent on a BAT.

• Territorial tax system: The President and House plans both proposed the adoption of a territorial tax system, similar to those used in other Western countries, in which U.S. companies only pay tax on profits earned domestically.

• Repatriation: The President’s recently announced tax reform proposal provides for a one-time tax on deemed-repatriation on past earnings held offshore. The President’s proposal did not specify the rate. An earlier campaign proposal suggested a tax rate of 10 percent on these earnings while the House Blueprint proposes a lower rate of 8.75 percent.

There is little doubt that tax-reform legislation, in whatever form it is enacted, will have far-reaching implications, all of which will affect tax planning. Not only will cash taxes be affected, but there will likely be significant impacts to companies’ financial statements for example, to the carrying value of deferred taxes.

Many corporations are strategising planning for tax credits and other attributes as well to maximise their value. And, of course, the adoption of a territorial tax system would have broad implications for a company’s balance sheet and P&L amounts. A U.S. BAT could require the modification of existing or even the codification of a new accounting standard for tax. These types of ripple effects should motivate tax executives to evaluate various scenarios as they become more likely and to involve their finance and accounting counterparts, as well as other stakeholders in these activities.

Brexit

On March 29, U.K. Prime Minister Theresa May activated the legal plans for Britain’s departure from the European Union. Referred to as Article 50, the surprisingly brief document initiates the lengthy and complex negotiations between Britain and the EU on the terms of their divorce. These terms cover the money the EU says Britain owes it (more than $60 billion), citizenship and immigration changes, the movement of workers, regulations, and Britain’s post break-up access to the EU market among many other issues. The sides have two years, to complete these negotiations and much more (the March 29, 2019, deadline that can be extended, but only if all 28 EU member countries agree to an extension).

In addition to the divorce, British government will enact the “Great Repeal Bill,” which is designed to let Parliament integrate aspects of EU legislation it wants to keep into British law while doing away with the EU laws it wants to jettison.

Additionally, the UK will design a new trade agreement with EU that May wants to provide a “barrier-free access to each other’s market,” according to The Economist, which notes that such a trade deal will be “tricky to agree on, and even harder to ratify” in 24 months given that the EU-Canada trade agreement approved earlier this year required 10 years of negotiations.

The tax implications of Brexit will become clear as negotiations concerning the divorce – and subsequent trade marriage – progress. Once the divorce is finalised, tax exemptions on transactions between UK and EU companies will no longer apply. Since UK companies now operate under EU tax treaties when dealing with non-EU countries, new tax treaties will need to be created, which will also require significant time and back-and-forth to negotiate. At this early point in the withdrawal negotiations, a prospective soft exit currently appears unlikely.

If Brexit means that the Directive on Administrative Cooperation and the Arbitration Convention no longer applies to UK MNEs, there likely will be a significant impact on dispute resolution due to disparate burden of proof requirements.

The UK will remain a member of the OECD, G20, and WTO. As such, it will remain part of efforts to harmonise international trade and business practices. The question remains as to what specific bilateral or multilateral trade treaty standard will apply to a post-Brexit Britain. The UK will continue to subscribe to the Common Reporting Standard (CRS) and other transparency initiatives, as well as participating in the US FATCA reporting regime. While the recent French elections appear to make France’s exit from the EU unlikely, it is possible that one more EU members could follow Britain’s lead.

BEPS

Britain, like the US and numerous other countries, has adopted the OECD’s CbC reporting requirements that are part of Base Erosion and Profit Shifting (BEPS) initiative Action 13. CbC reporting requirements pose a major data-collection challenge to companies and their tax functions. With information-sharing of CbC reports among OECD countries set to begin in 2018, tax functions should be prepared for an increase in audit activity. While the precise burden CbC reporting places on MNEs continues to emerge, some tax executives already have expressed a desire to reconcile the CbC report to other to other tax and financial sources of data (e.g., local tax returns, local statutory and SEC filings, and U.S. form 5471) prior to submitting the CbC report.

To complete these reports, tax functions will need to process the data early and often to spot errors at the source and make corrections in advance of the filing deadline; drill to the lowest level of detail (i.e., journal entry or lower) to gain insights into the final results; access multiple years of data with full audit trails; process multiple scenarios and view the outcomes in the CbC reporting format for strategic planning; and conduct the necessary reconciliations.

EU State Aid

The EU’s Fiscal State Aid investigations show no signs of letting up, which means that tax planning remains crucial – and complicated – for MNEs doing business in (or considering expanding to) EU countries. These investigations hinge on whether previously legal tax agreements between individual EU countries (i.e., member states) and MNEs qualify as unlawful State Aid. When an agreement is deemed unlawful, the EC may recover aid (i.e., tax breaks) that have been paid out, plus interest. If the member state does not comply with the decision in a specified amount of time, the EC can refer that country to the European Court of Justice.

In March, the EU Commissioner in charge of competition reaffirmed the European Commission’s (EC’s) commitment to the State Aid modernisation effort it began five years ago. “The modernisation of State Aid rules, which we started in 2012, is benefitting both those that receive state aid and public authorities,” Commissioner Margrethe Vestager stated. “More than nine out of ten new aid measures are being paid out without requiring prior authorisation from the Commission.

This avoids unnecessary delays and allows us to focus our efforts on state aid more likely to cause competition and trade problems.” The efficiency that Commissioner Vestager described enables the EC to focus more time and attention on investigations concerning cases “most liable to distort competition,” which covers instances of unlawful state aid. From a tax-planning perspective, the EC’s continued commitment to its sniffing out unlawful State Aid requires sustained vigilance. Additionally, an understanding of the EU’s competition rules and the mechanisms of the single markets is helpful, even though this typically falls outside of the purview of tax planning.

Tax Planning and Tax Technology Implications

All of the icebergs that MNEs must navigate around require a vigilant, rigorous form of tax data management, as well as the latest technology The stakes for corporate tax functions have never been higher. US tax reform (should it survive the political and legislative process), Brexit, BEPs and EU State Aid investigations intensify the tax function’s data-management burden. As a result, tax planning and tax management are becoming more data-driven than ever. Tax functions will need to segregate and allocate data to satisfy more detailed information-reporting requirements and to conduct agile tax planning. More precise methods of organising and analysing this data will be necessary.

To achieve the agility that their functions require, tax executives should have a plan. While the specific course they wish to chart will depend on the unique characteristics of their industries, companies and markets, tax executives are more likely to swiftly navigate current waters by considering the following actions:

• Be prepared: Advanced tax functions within MNEs have begun leading scenario-planning activities based on major tax changes (e.g., possible outcome of US tax reform) with their senior colleagues.

• Expect more audits and increased M&A activity: EU State Aid investigations and BEPS CbC reporting requirements are likely to spur more tax audits around the world. As governments and regulators heighten transparency requirements, their enforcement arms will have more ammunition for audits. New disparities in regional tax-compliance burdens around the world also appear likely to stimulate mergers and acquisitions that help companies operate in more tax-friendly locations and under more tax-intelligent organisational structures. For example, if the US enacts a 15 percent corporate tax rate along with a territorial tax system, companies based outside the US might look to relocate to the US and/or acquired US-based companies.

• Recognise ripple effects: The disruptions discussed above will affect global trade, currency strengths, the cross-border movement of employees and business operations and so much more. For example, the House Blueprint that includes a new BAT and/or mandatory repatriation could have major implications on balance sheets and also on existing accounting approaches and standards.

• Act now: Given the high level of uncertainty on the horizon, tax functions should move quickly to implement the skills, processes and technology necessary to comply with known requirements well before compliance deadlines arrive.

A strong tax technology system can help tax functions take swift, effective actions in response to changing reporting and regulatory requirements.

The best forms of tax technology tend to have these capabilities:

• Data management and advanced analytics

• Access to quality data

• The ability to consolidate transactional data across multiple systems

• The ability to easily bring together tax data, synchronise it, transform it and retain it for the future

• Data imaging technology to capture and manage unstructured data

• Portals for sharing data

When deploying the right form of tax automation, tax functions can collect, harmonise, transform and access the massive amounts of data required to satisfy compliance requirements around the world and become more agile and strategic business advisors that contribute to the bottom line operations of their business. As uncertainties lurking on the horizon, and below the surface, rise to the level of full-fledged risks, the highest-performing tax teams will be those that demonstrate the greatest planning and navigational agility.

ABOUT THE AUTHORS

Nancy Manzano is a Director in the Chief Tax Office at Vertex, Inc., providing insight regarding in-house corporate tax department operations, and supports the development of the company’s income tax solutions under Vertex Enterprise. She holds an M.S. in Taxation and is a licensed CPA

Bernadette Pinamont is the Chief Tax Officer – Income Tax at Vertex, Inc. providing insight regarding in-house corporate tax department operations with respect to income and inter- national tax matters, including transfer pricing. She is a lawyer and a licensed CPA.

George L. Salis is a Principal Senior – Tax Compliance at Vertex, Inc. He is also a Certified Business Economist (CBE) and tax lawyer specialising in International and European Taxation, Transfer Pricing, and Economic Law.

0 Comments