Tollymore has developed six behavioural constraints impairing institutional money managers’ execution of a sound long term investment programme. The pursuit of informational edge Overconfidence can have profound consequences, inflating investors’ valuation of their investments, leading ...

The importance of change management is becoming evident. Established organisations such as Barclays Capital are even hiring treasury change management executives. The message is clear: change is inevitable, and those who do not proactively work ...

With fintechs and other challengers moving in on the most profitable parts of corporate banking such as international money transfers and the provision of FX services, and digital payment processors racing to sign up as ...

Founder of BELLIN, the company that bears his name, Martin Bellin is widely held to be a treasury management visionary. Here he talks of building upon all that has been achieved over the last two ...

By now you’ve certainly heard a lot about the major changes, as well as some of the immediate impacts of US tax reform (“tax reform”). But the headlines don’t tell the full story – some ...

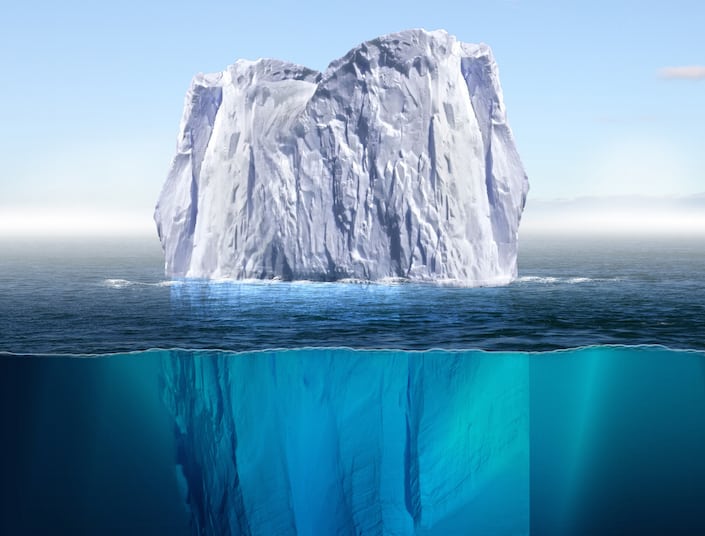

A strange-but-true look at the tax-planning impacts of pivotal economic, political, trade and regulatory changes Who could have imagined that last year’s stunning Brexit vote was only the tip of the iceberg? Yet, here we ...

CEO Insight: How does BELLIN champion innovation in treasury? Why is this such a key value to you? Martin Bellin: BELLIN is not a software company in the traditional sense. We’re first and foremost ...

The world of business is expanding, corporations of all sizes are becoming more international and treasury is playing an increasing role in corporate finance. Much of this newly-gained clout is owed to the way in ...

As new tax rules proliferate and governments call on companies to demonstrate greater tax transparency, corporate tax functions need to strengthen their tax determination, tax data management and tax reporting capabilities. This need drives more ...

Anxious hand-wringing over the future of international trade has been rampant since the United Kingdom voted in June 2016 to leave the European Union. Although at this point it appears the UK will not abandon ...

Treasury management system implementations introduce efficiencies to your organisation’s treasury operations and encourage your team to think proactively about future improvements that can be made. At the moment, you may be at the beginning, in ...

How the Right Technology and Effective Planning Can Keep You Afloat Global tax planning has never been smooth sailing, but it is arguably one of the most value-added functions performed by tax departments in multinational ...

Vertex is the leading and most trusted provider of comprehensive, integrated tax technology solutions for corporations worldwide. From producing tax reference manuals in 1978 to the introduction of Vertex® Enterprise—the industry’s first true comprehensive tax ...

Founded in 1998 in Germany, Bellin today consists of over 120 employees focused on creating solutions that reflect a pragmatic approach to solving treasury problems. Bellin‘s solutions are designed to be easy to use by ...

The OECD Base Erosion and Profit Shifting (BEPS) project was designed to provide an internationally coordinated approach to protect tax bases and provide comprehensive international solutions to the problems of base erosion and profit shifting. Ireland ...

On October 5, the OECD issued it formal recommendations on the Base Erosion and Profit Shifting (BEPS) Action Plan. These recommendations have been subsequently adopted by the G20. We acknowledge the monumental effort that ...

The changing global landscape of international tax entail challenges for multinational companies in adjusting and adopting their investment approach to the new regulatory environment. Regulatory changes There are currently several ongoing regulatory changes within the ...

The corporate tax practices of multinational corporations are under siege by world leaders, NGO’s, the OECD and EU tax authorities. All demanding multinationals to pay their “fair share” and more than willing to highlight perceived ...